New Year’s Eve 2025: The Growing Divide in U.S. Hotel Performance

New Year’s Eve 2025: A Tale of Two Tiers in the Hotel Industry

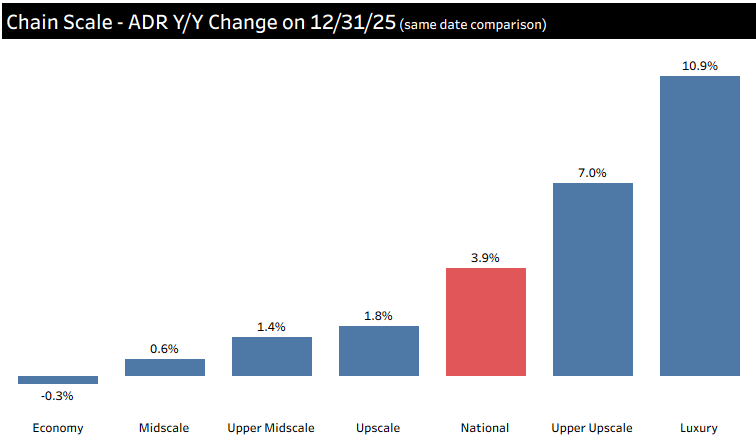

The national hotel market closed out 2025 on a positive note, with overall room rates on New Year’s Eve climbing 3.9% compared to the previous year. However, this national average masks a significant divide in how different market segments performed as travelers rang in the new year.

The Luxury Surge vs. Economy Stagnation

The primary driver of the national increase was the high-end market, which saw robust demand and pricing power. Conversely, the budget-friendly segment struggled to maintain its year-over-year pricing.

• Luxury ADR experienced a significant jump of 10.9%.

• Upper Upscale and Upscale segments also saw growth of 7.0% and 1.8%, respectively.

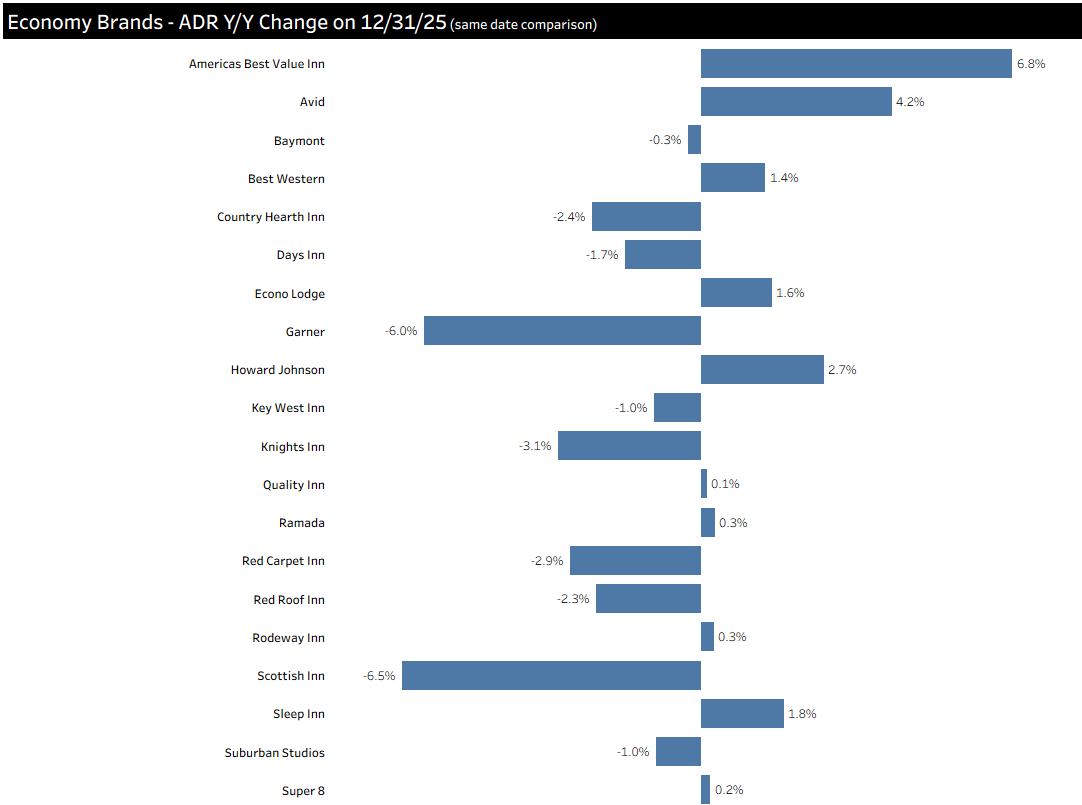

• The Economy segment saw its ADR actually shrink by -0.3% compared to the previous year.

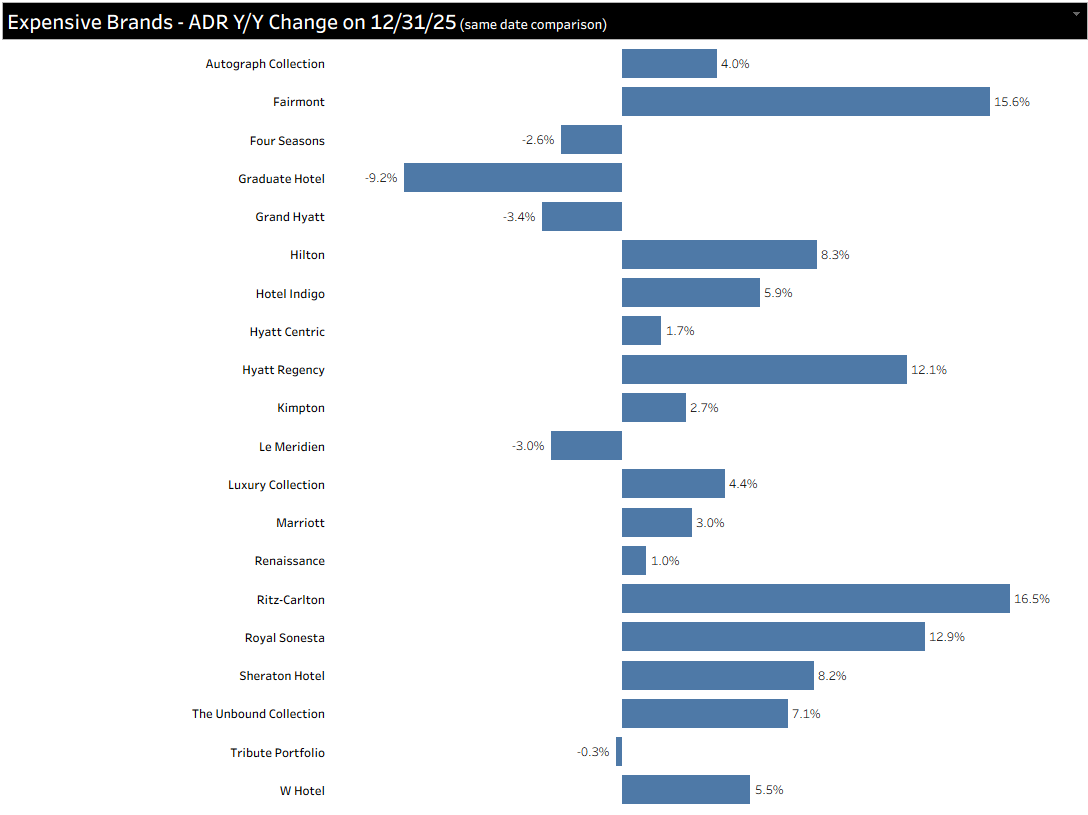

Brand Performance: High-End Winners and Budget Standouts

Performance varied wildly by brand, with some luxury names seeing double-digit growth while others faced corrections.

• Ritz-Carlton and Fairmont led the high-end category with impressive ADR growth of 16.5% and 15.6%, respectively.

• Royal Sonesta (+12.9%) and Hyatt Regency (+12.1%) also posted strong year-over-year gains.

• In contrast, Graduate Hotel (-9.2%) and Grand Hyatt (-3.4%) saw the largest declines among the top 20 expensive brands.

• In the economy segment, Americas Best Value Inn outperformed its peers with a 6.8% increase.

• Scottish Inn and Garner faced the steepest declines in the economy category, dropping -6.5% and -6.0%, respectively.

Geographic Hotspots and Cool Zones

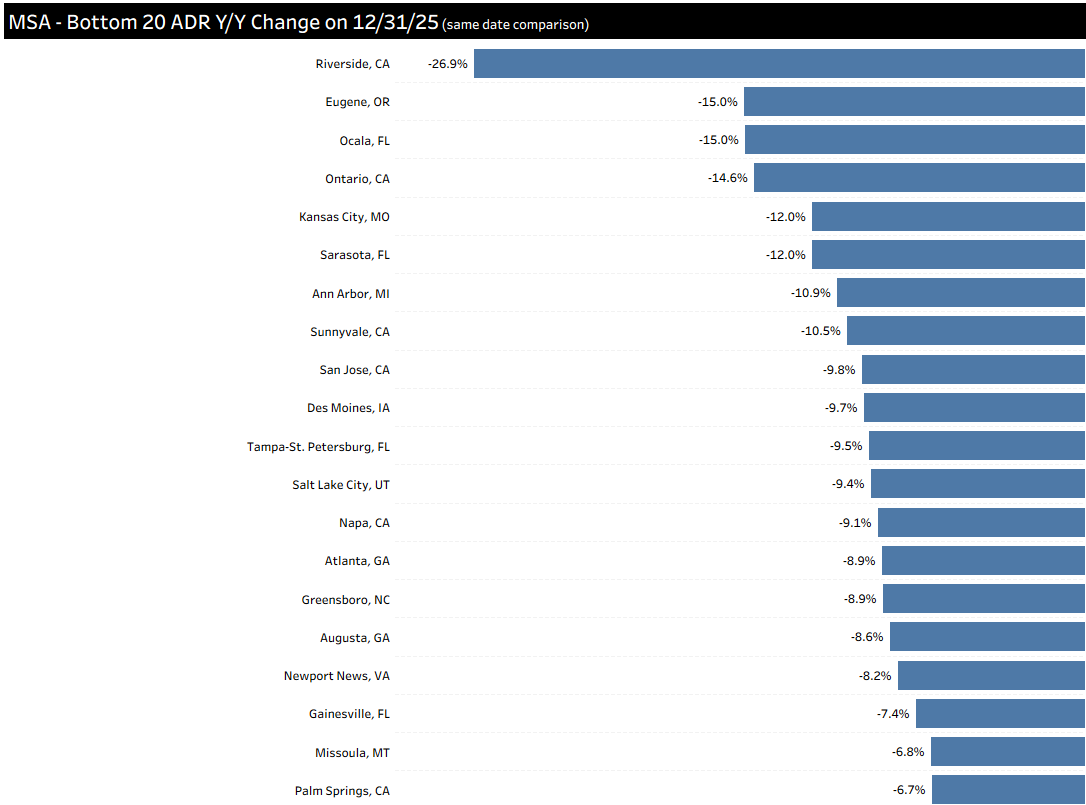

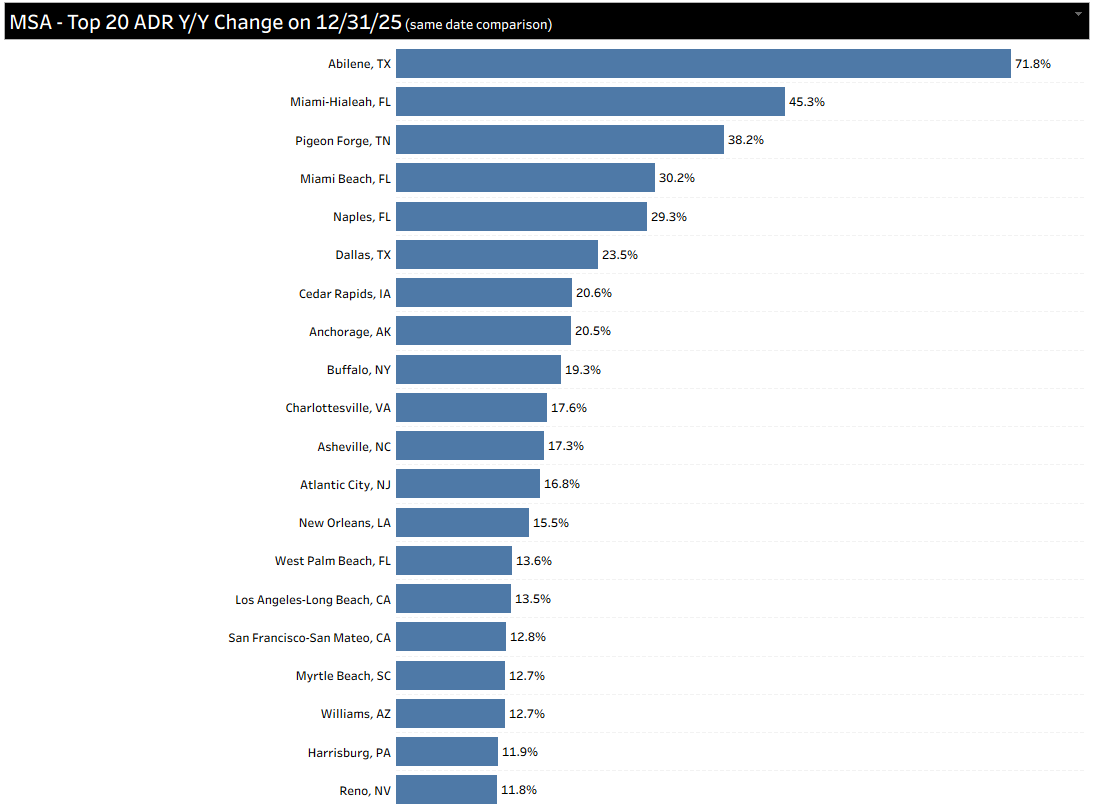

Location remained the most critical factor for New Year’s Eve pricing, with several Metropolitan Statistical Areas (MSAs) seeing astronomical growth while others saw a sharp pullback.

• Top Growth Markets: Abilene, TX, was the standout performer with a staggering 71.8% increase in ADR. Other high-growth areas included Miami-Hialeah, FL (+45.3%), and Pigeon Forge, TN (+38.2%).

• Steepest Declines: On the other end of the spectrum, Riverside, CA, saw rates plummet by -26.9%. Eugene, OR, and Ocala, FL, both saw identical declines of -15.0%.